Insurance premiums are paid in advance to insurance and occupational pension companies to provide insurance coverage for an agreed-upon period. This means that there is a delay between the payment of the premium and the payment of any compensation in the event of a claim or, for example, the expiration of an endowment insurance policy.

For pension and life insurance, there is typically many years between the payment of premiums and the pay-out in the form of a pension or other savings. In addition to payments, the premiums also cover various operating costs, such as rental expenses and salaries for insurance company employees.

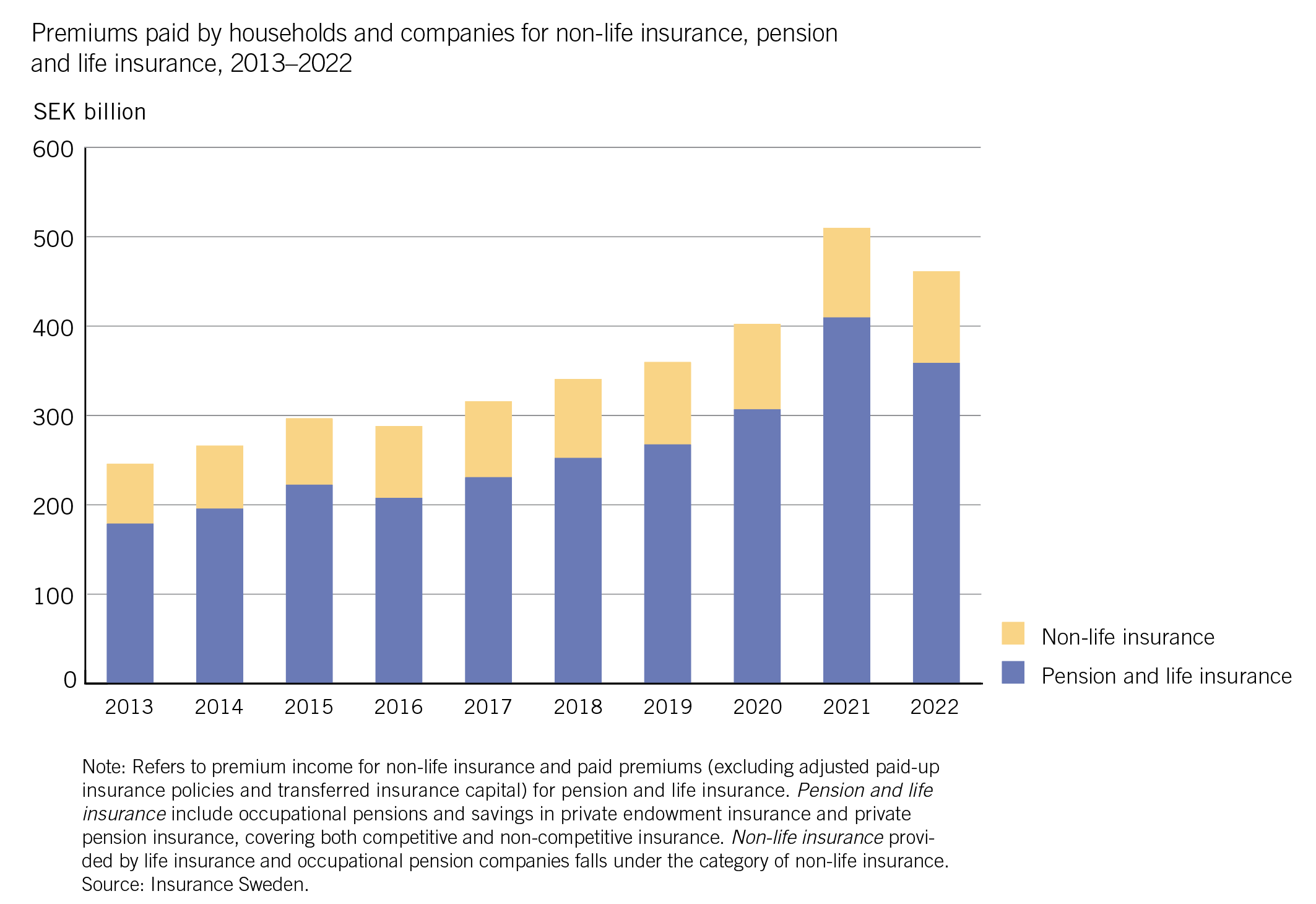

For non-life insurance, the premiums amounted to a total of just under 103 billion SEK in 2022, of which over 23 billion SEK was paid by companies and over 79 billion SEK was paid by households. For pension and life insurance, the paid premiums amounted to just under 359 billion SEK. Compared to 2021, premium payments for pension and life insurance decreased by 12 per cent, while premium income for non-life insurance increased by 2 per cent.

It is common for an individual to have multiple types of insurance, such as home insurance, motor vehicle insurance, and occupational pension. In 2022, the average premium paid per person in Sweden was approximately 8,200 SEK for non-life insurance and around 34,100 SEK for pension and life insurance. However, it is not always the individual who pays the premium. Approximately 55 per cent of the premiums for pension and life insurance are paid by employers in the form of occupational pensions. Some of the premiums for non-life insurance are also paid by employers, for example, certain accident insurance and healthcare insurance policies.