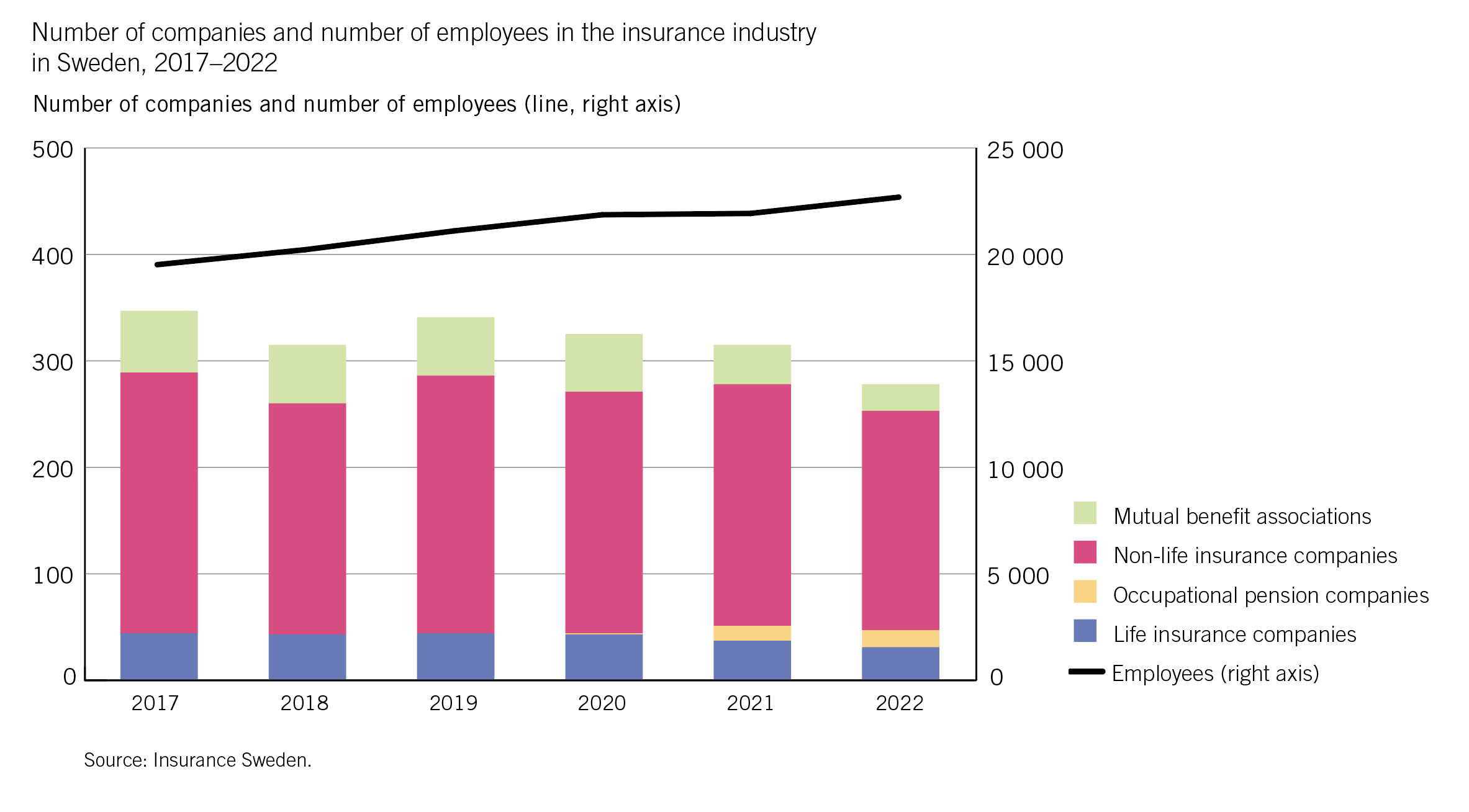

The Swedish insurance industry comprises 31 life insurance companies, 16 occupational pension companies, 206 non-life insurance companies, and 25 mutual benefit associations

Out of these 278 insurance and occupational pension companies, 34 are foreign-owned and represented in Sweden through branches or agencies. The number of foreign companies has remained mainly unchanged over the years. Most companies are either larger nationwide or smaller local companies.

The number of companies has varied over the years, but compared to 2017, the number of companies has decreased by 20 per cent. It is primarily mutual benefit associations that have become fewer, and according to current legislation, mutual benefit associations are to be phased out gradually. Mutual benefit associations do not engage in commercial insurance operations but instead focus on mutual assistance for their members, such as a professional group. Common benefits in mutual benefit associations include pensions, sickness benefits, or funeral assistance. Occupational pension companies have emerged since 2020. Two former non-life insurance companies and 14 former life insurance companies have converted into occupational pension companies during the period 2020-2022. The regulations differ between insurance companies and occupational pension companies. Insurance companies are governed by the Insurance Business Act, while occupational pension companies are governed by the Occupational Pension Companies Act, which was introduced in late 2019.

The industry employs nearly 23,000 people, which corresponds to approximately half a per cent of the total number of employees in the Swedish labour market. While the number of companies in the insurance industry has decreased by 20 per cent since 2017, the number of employees has increased by 16 per cent.

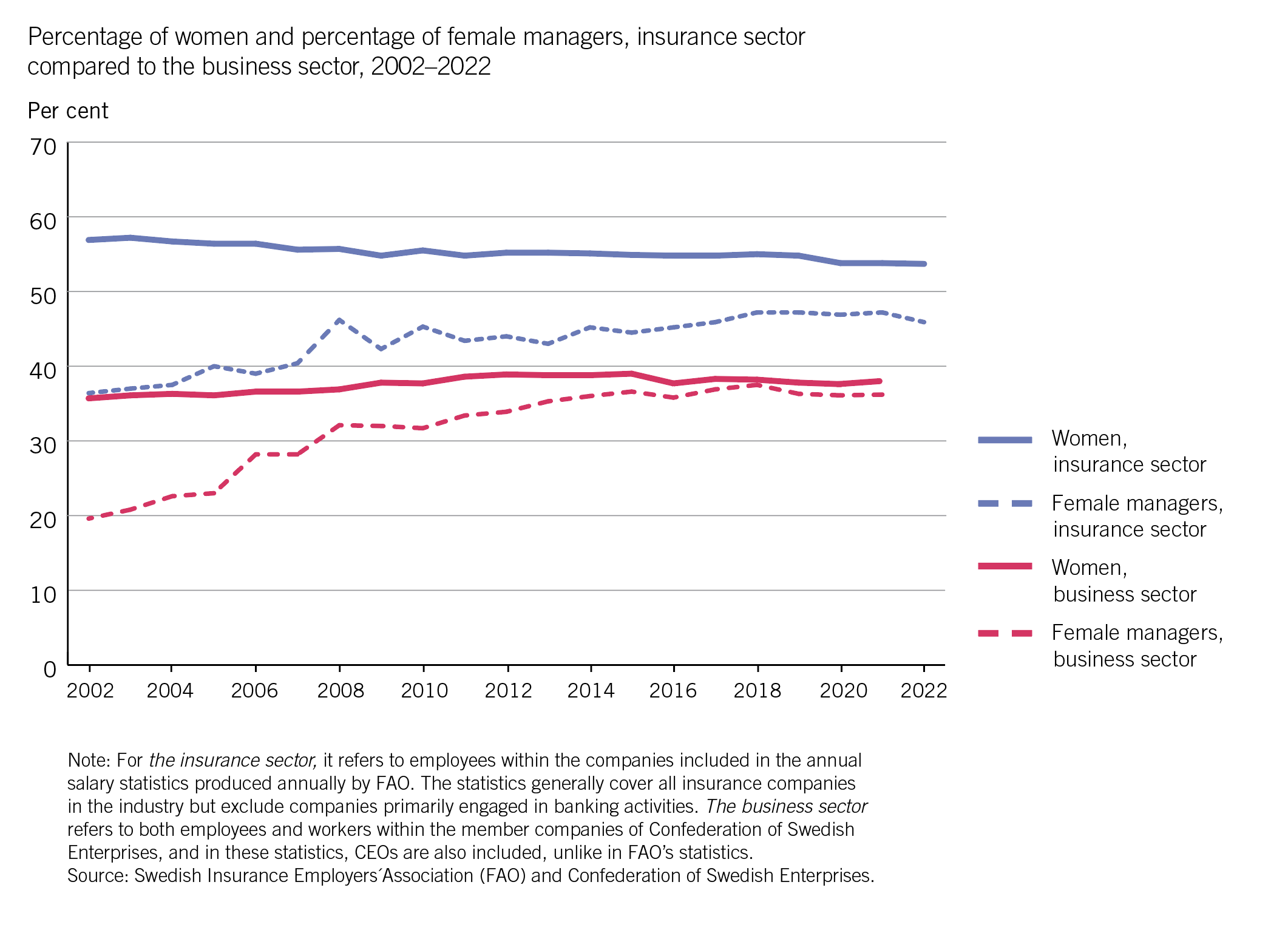

The Swedish insurance industry has a relatively equal gender distribution. In 2022, over half, 54 per cent, of the employees in the industry were women. The proportion of women has consistently been slightly higher than the proportion of men since the early 2000s.

The proportion of female managers has been gradually increasing over time. In 2002, just over 36 per cent of managers were women. The corresponding figure in 2022 was 46 per cent, which means close to half.

Both the proportion of women and the proportion of female managers are higher in the insurance industry than the average in the whole business sector, where the corresponding figures are 38 per cent and 36 per cent, respectively.

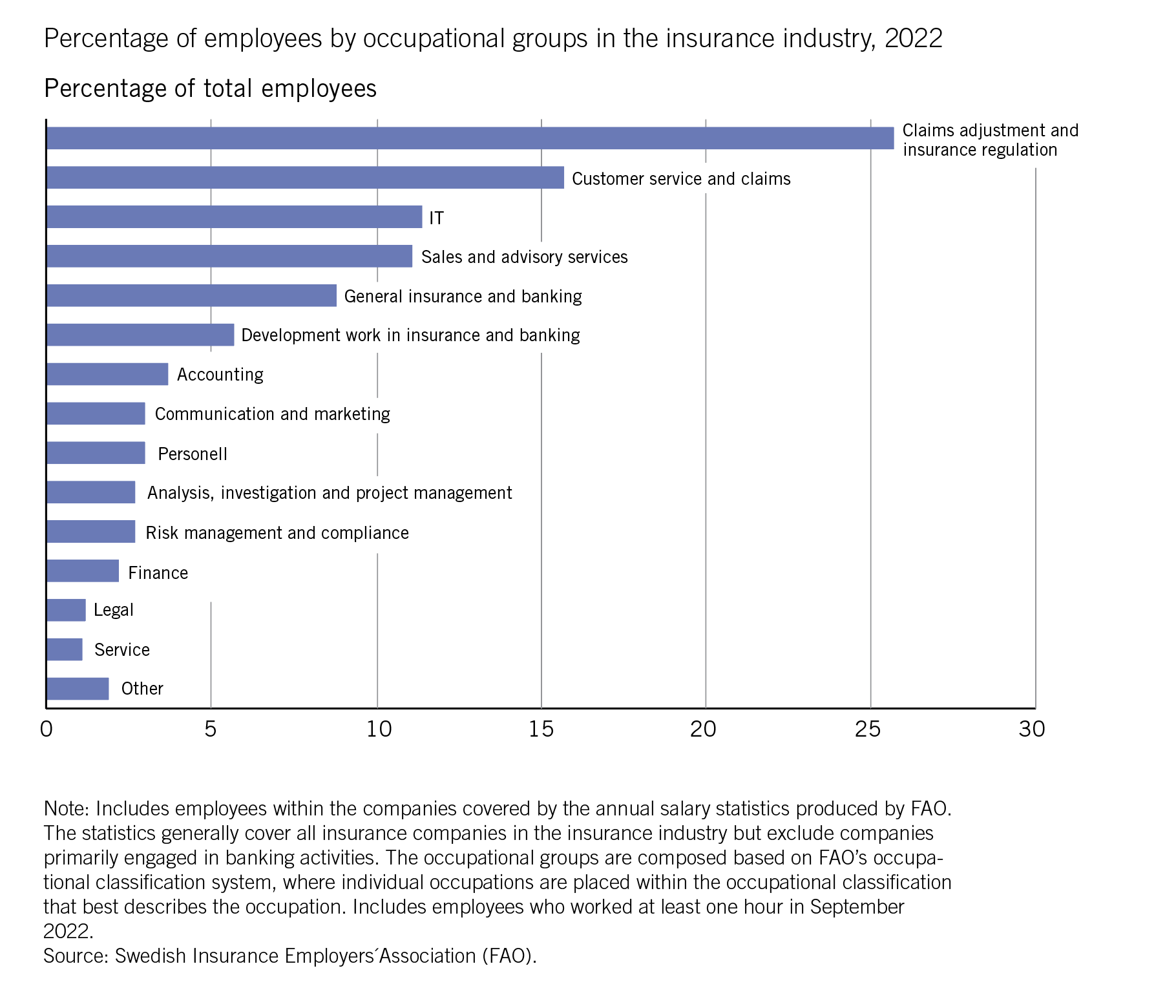

A little more than a quarter of the employees in the insurance industry work in claims adjustment and insurance regulation. This occupational group includes investigations into the causes and liability of damages, as well as services involving risk assessments and analysis of reinsurance for other companies. Certain specialized professions, such as actuaries (insurance mathematicians), are also part of this occupational group. Other common occupations include customer service and claims, which are carried out by around 16 per cent of employees, followed by IT work (11 per cent) and sales and advisory services (11 per cent).