There are many different insurance policies that provide coverage for damages to property and belongings owned or rented by households and companies, such as homes, houses, holiday homes, boats, cars, and other motor vehicles.

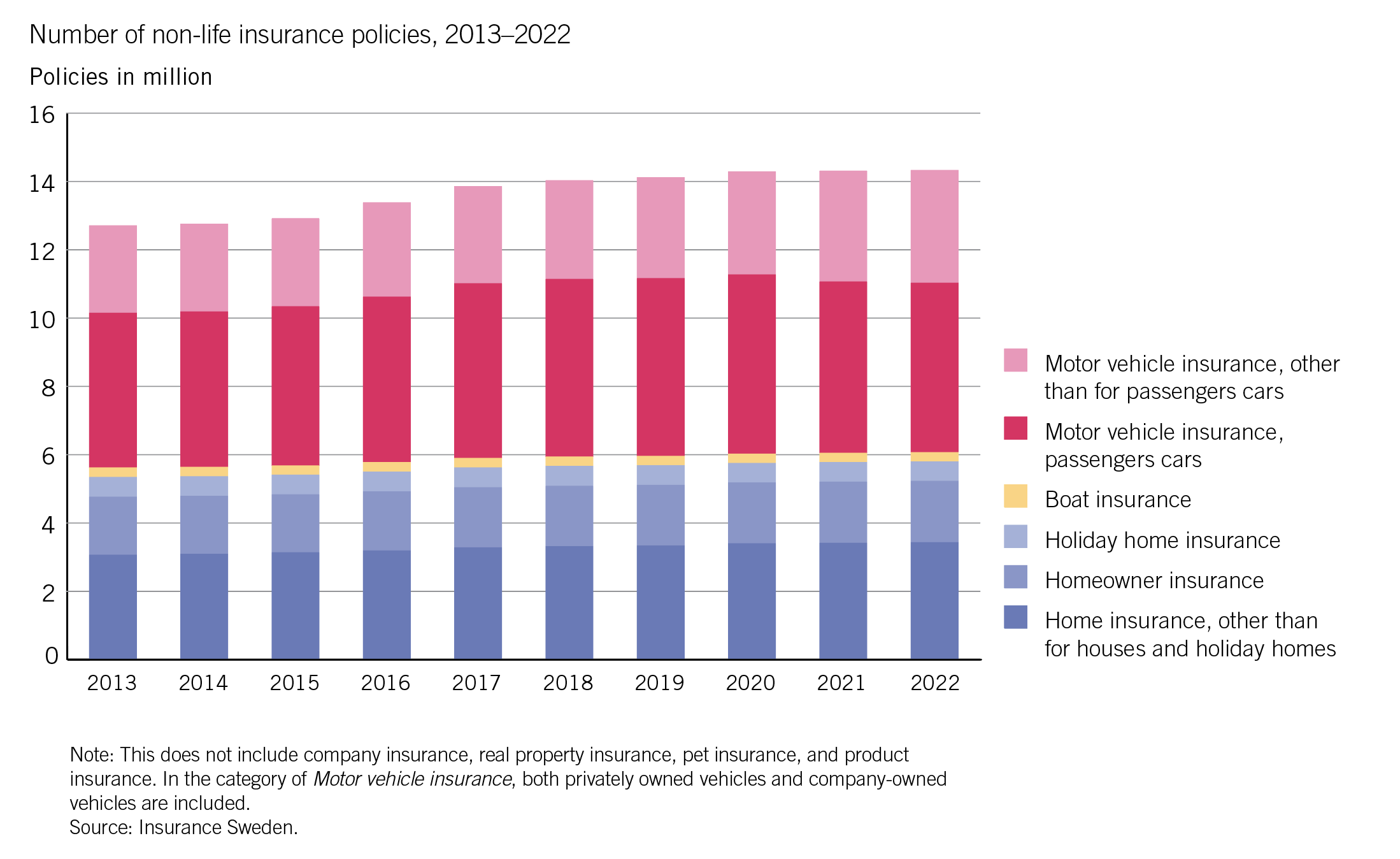

Motor vehicle insurance is the most common policy among household insurances. At the end of 2022, there were nearly 5 million insured passenger cars and over 3.3 million other insured motor vehicles.

Home insurance and houseowner insurance are also common policies. Houseowner insurance covers not only the costs for damages covered by regular home insurance but also serves as financial protection for damages that may occur to the actual property. In 2022, the number of home insurance policies amounted to over 3.4 million, and the number of houseowner insurance policies was just under 1.8 million. In total, there were nearly 14.3 million property insurance policies in 2022.

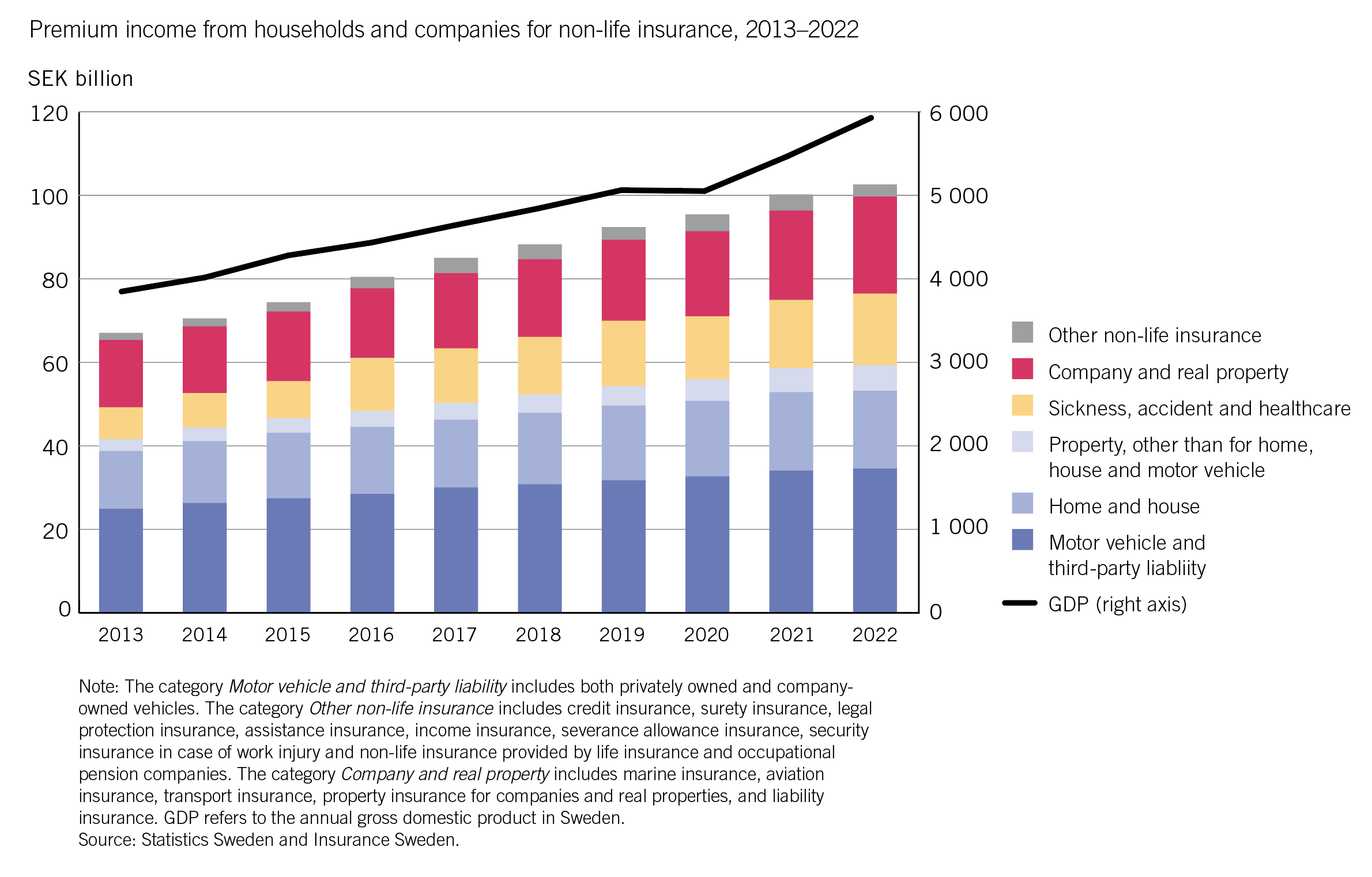

In total, households and companies paid nearly 103 billion SEK in premiums for various non-life insurance policies in 2022 (see figure 9).

Most of the payments were made by households and went towards premiums for motor vehicle and motor third party liability insurance (34 per cent) and home and houseowner insurance (18 per cent). Just over one-fifth (23 per cent) of the total premiums were paid by companies for business and real property insurance.

Over the past ten years, non-life insurance premiums have increased by 53 per cent. This increase can be partially explained by economic growth (GDP), as the demand for non-life insurance often rises when households' and companies assets grow.