The vast majority of all employees in Sweden have an occupational pension insurance. Occupational pension is a supplement to the national public pension and has become increasingly important for the total pension of many individuals over time.

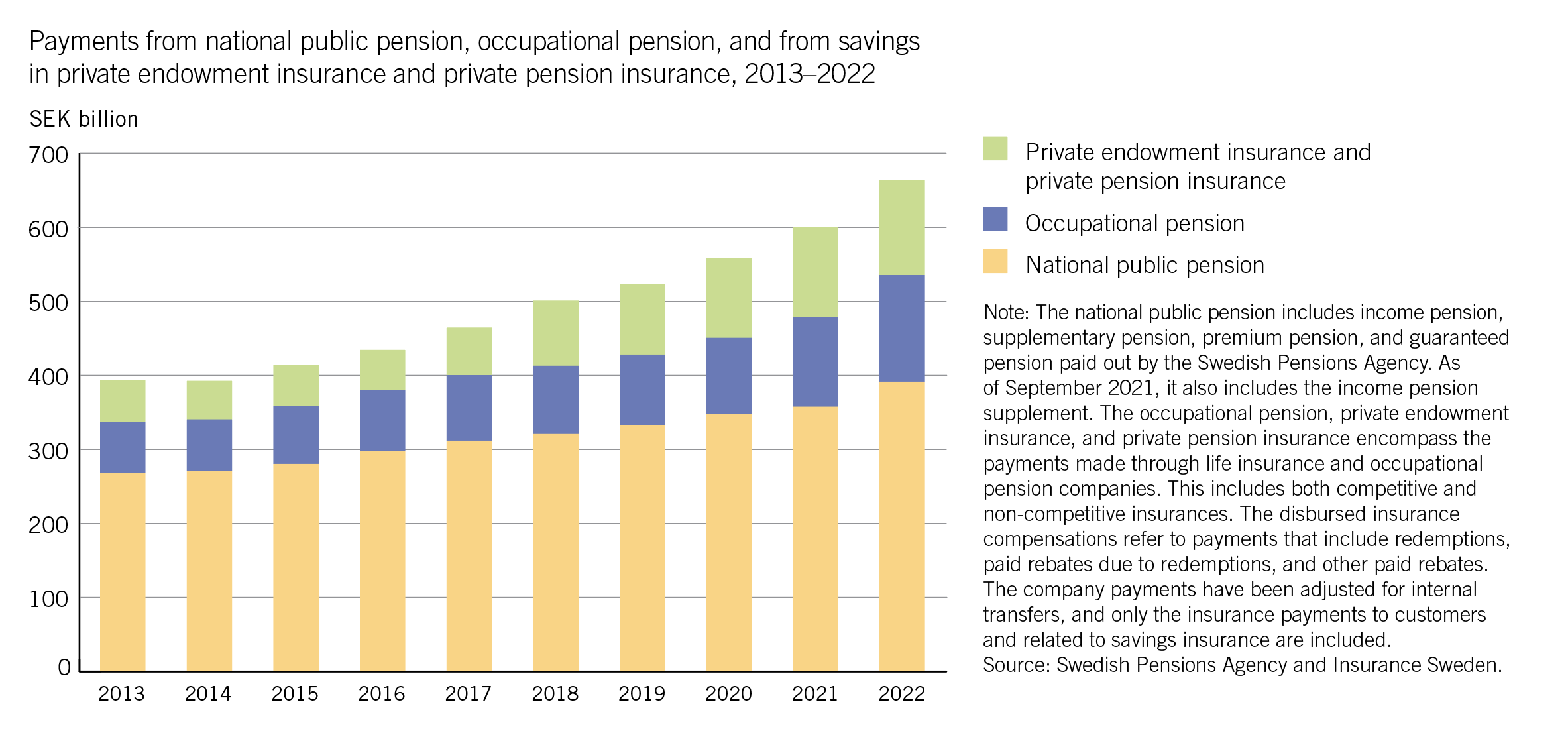

In 2022, the Swedish Pensions Agency paid out over 391 billion SEK in national pension. The national public pension includes income pension, supplementary pension, premium pension, guarantee pension, and as of September 2021, also the income pension supplement (see figure 30).

As a complement to the national public pension, life insurance and occupational pension companies offer employers and individuals the opportunity to take out occupational pension insurance and private pension insurance. The companies also offer private endowment insurances that are not specifically intended for pension savings. This is because there is the possibility to deposit and withdraw the entire or parts of the capital during the savings period, and the capital is therefore not locked until retirement. Endowment insurances serve more as a "wrapper" for various investment products, where the policyholder can choose beneficiaries and structured payouts. Payments from occupational pension insurance, private pension insurance and endowment insurance amounted to 273 billion SEK in 2022.

The combined payments from the national pension, occupational pension, private endowment insurance and private pension insurance have increased by 69 per cent (271 billion SEK) between 2013 and 2022. The share represented by payments from occupational pension insurance has increased from 17 to 22 per cent during the same period.

The share of occupational pension in total pension payments is higher than what is shown in figure 30. An employer can also finance and secure their occupational pension commitment internally by including the pension obligations in the company's balance sheet or making contributions to a pension foundation. If the company adopts an internal financing method, a credit insurance is required to secure the employees' pensions in case the company becomes insolvent. PRI Pensionsgaranti guarantees and administers paid pensions within the agreement for privately employed white-collar workers, ITP2, that is financed internally. According to PRI Pensionsgaranti, pension payments amounted to 7.7 billion SEK in 2022.