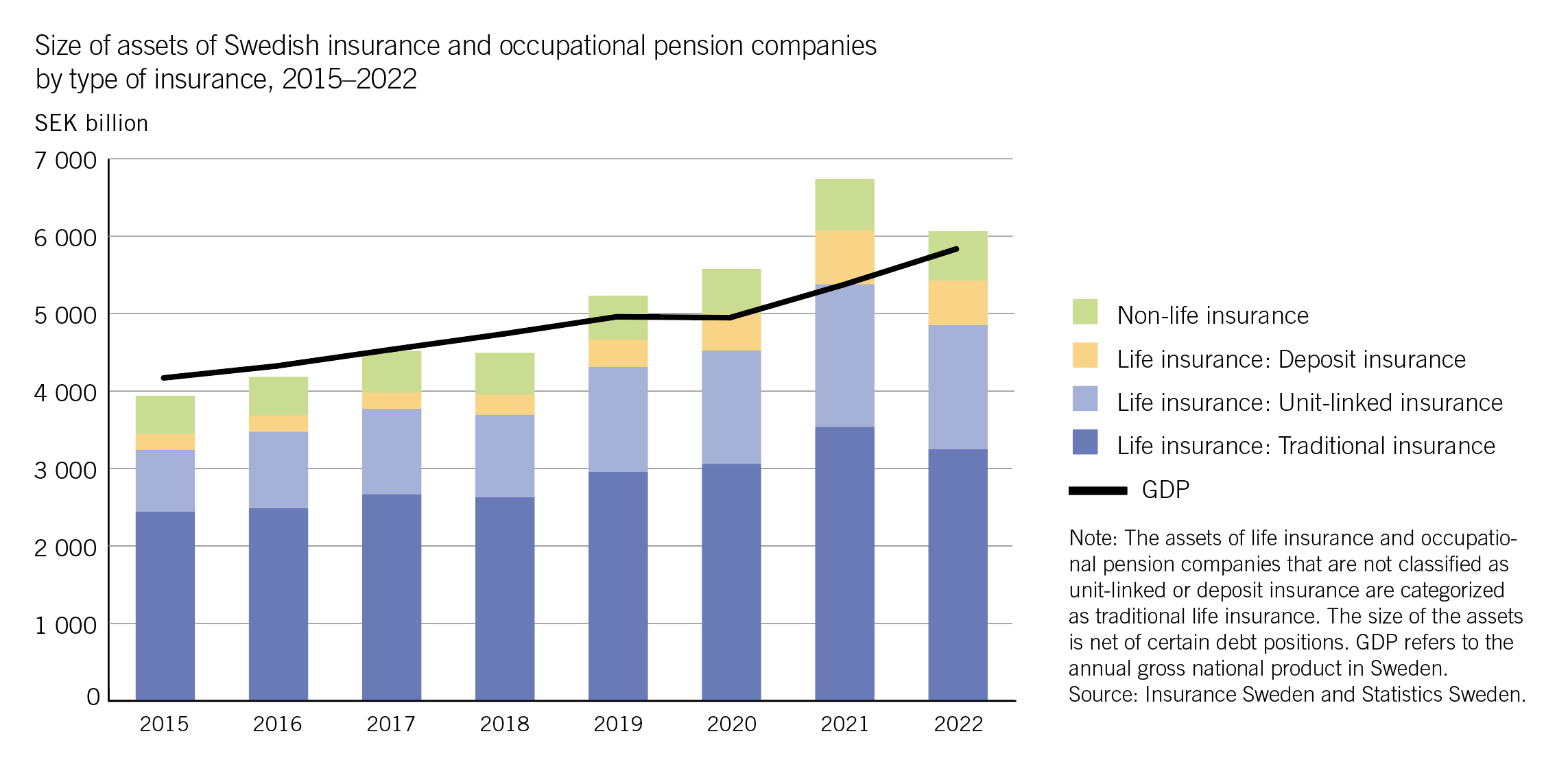

At the end of 2022, Swedish insurance and occupational pension companies had financial assets of nearly 6,100 billion SEK, which is larger than Sweden's gross domestic product (GDP).

These assets are invested in Sweden or abroad. The majority of the assets, about 90 per cent, are managed by life insurance and occupational pension companies, while the remaining part is managed by non-life insurance companies. The large assets held by life insurance and occupational pension companies are a result of premiums being saved over many years and the capital growing due to return on the assets.

The assets of life insurance and occupational pension companies are primarily related to traditional life insurance, but unit-linked and deposit insurance have seen an increase in recent years (see figure 34). In unit-linked and deposit insurance, policyholders choose which investment funds and other financial assets their capital should be invested in and bear the financial risk. This differs from traditional insurance, where companies choose how to manage the capital and bear the financial risk.

Of the investment assets held by life insurance and occupational pension companies, 60 per cent were tied to traditional insurance at the end of 2022, while nearly 30 per cent were tied to unit-linked insurance and almost 11 per cent to deposit insurance.