Within pension and life insurance, there are many different types of insurance policies that provide payments in connection with retirement, as well as various forms of savings.

An occupational pension insurance is a pension insurance where the insured person's employer has undertaken to pay all premiums for the insurance. The employee is the insured person and beneficiary of the insurance, while the employer is typically the policyholder who has taken out the insurance. If a person has had multiple employers throughout their life, he or she may be covered by several different occupational pension agreements. Occupational pension can also be taken out as an endowment insurance for occupational pension, for example, a so-called direct pension.

For both individuals and companies, it is also possible to save in a private endowment insurance or a private pension insurance. An endowment insurance is a form of savings that can be taken out by both individuals and companies, where the savings are invested in equities, funds, and other securities. Private pension insurance is a private pension savings with a tax deduction where the savings are paid to the policyholder when he or she reaches the age of 55. Private pension insurance can currently be taken out by entrepreneurs and individuals who do not have an occupational pension in their employment.

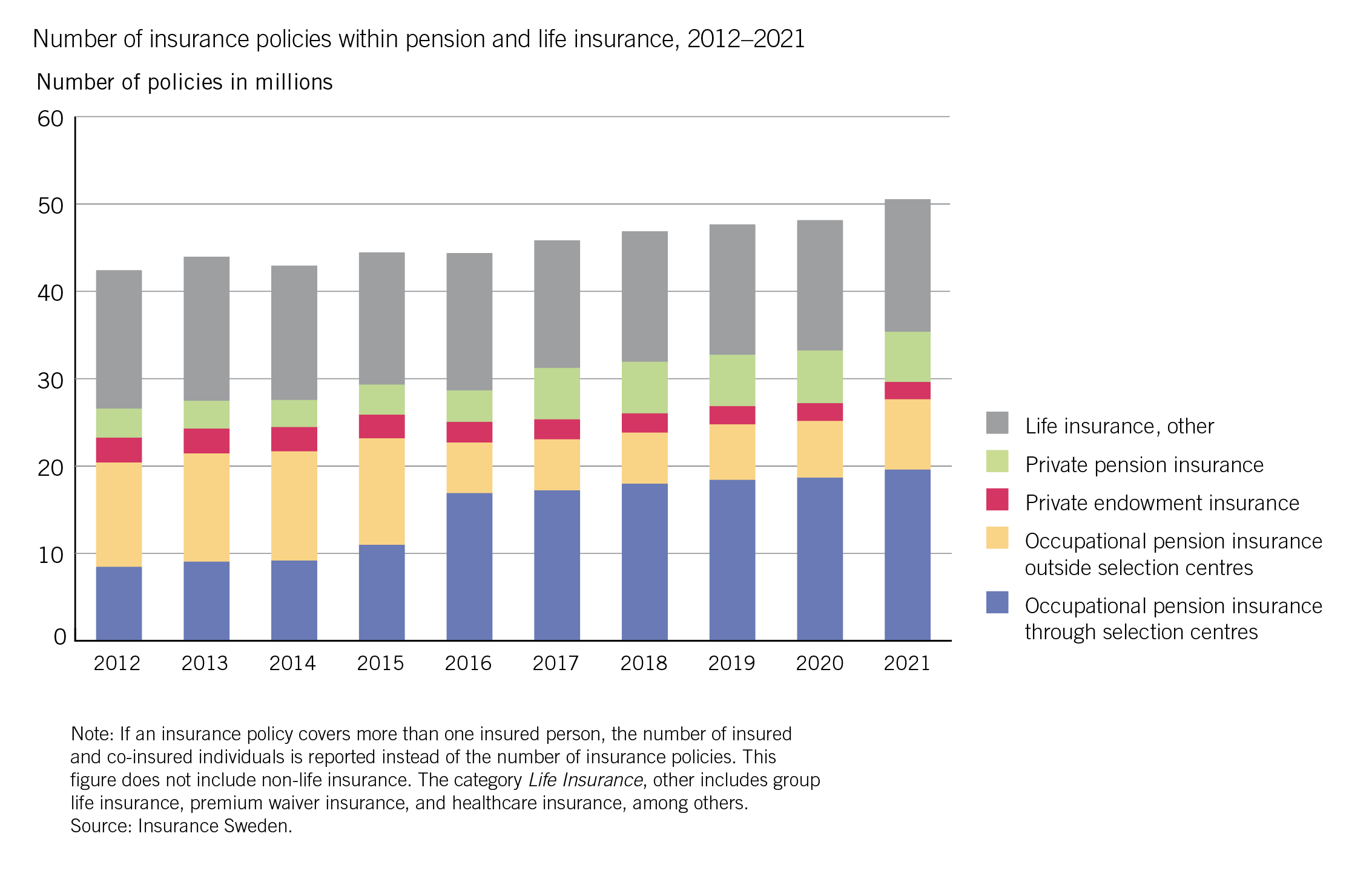

At the end of 2021, there were a total of nearly 51 million insurance policies in pension and life insurance (see figure 28). More than half (55 per cent) of these policies are occupational pension insurance. In addition, there were 5.7 million private endowment insurances and nearly 2 million private pension insurances.

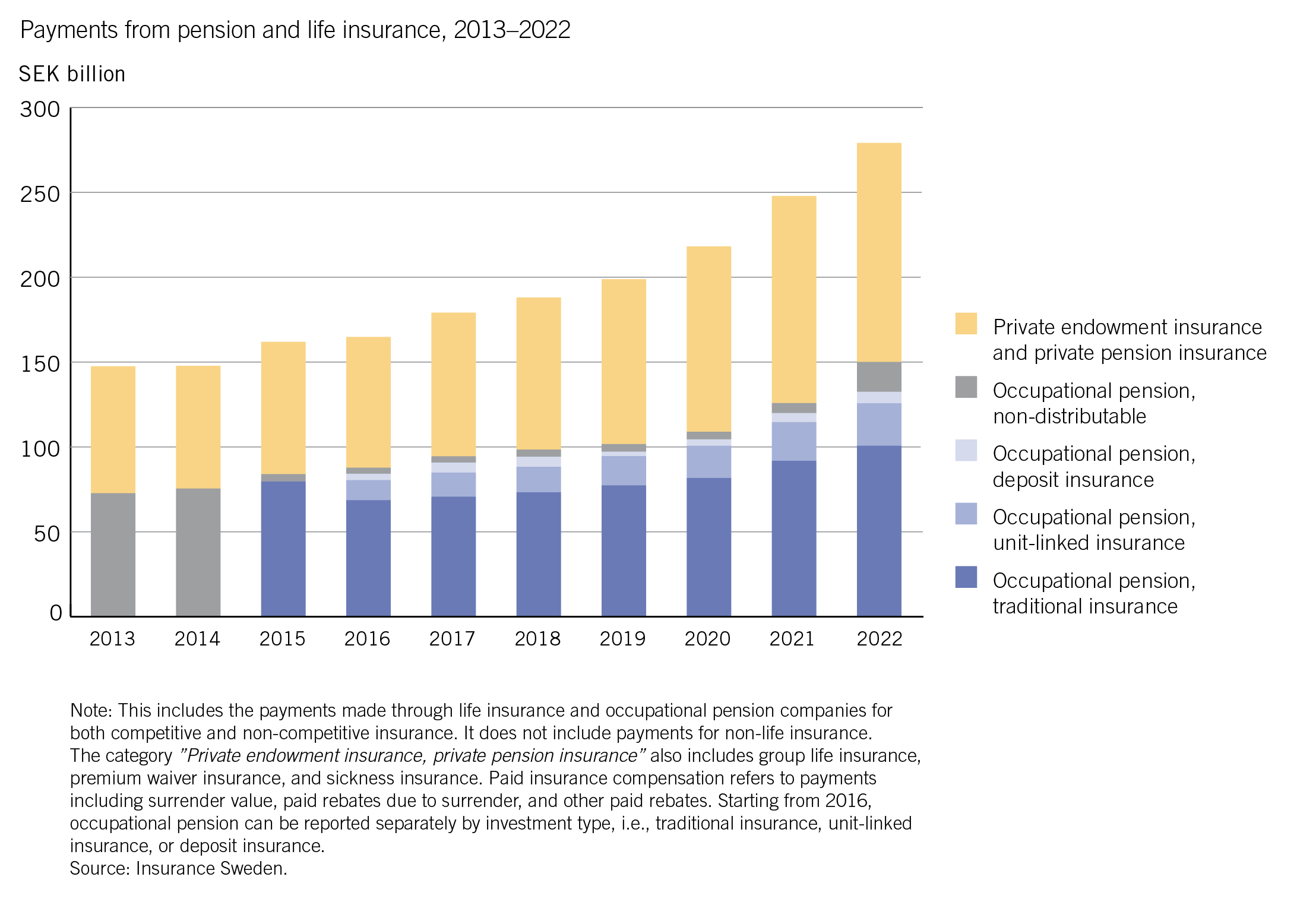

Life insurance and occupational pension companies pay out insurance benefits in the form of occupational pensions and from savings in private endowment insurance and private pension insurance, among others. In total, these companies paid out over 279 billion SEK in 2022 (see figure 29).

The largest share of the payments (54 per cent) consisted of occupational pension payments amounting to 150 SEK billion. Traditional insurance was the most common savings form. In the case of traditional insurance, it is the life insurance and occupational pension companies that choose the assets in which the capital should be invested and bear the financial risk. In the case of fund and deposit insurance, it is the policyholder who chooses the funds, equities, and other financial assets in which the capital should be invested and bears the financial risk.

Payments from savings, particularly in private endowment insurance, amounted to 129 billion SEK.

Over the past ten years, occupational pension payments have more than doubled, with an increase of 106 per cent. Payments from savings in private endowment insurance and private pension insurance have increased by 73 per cent during the same period.