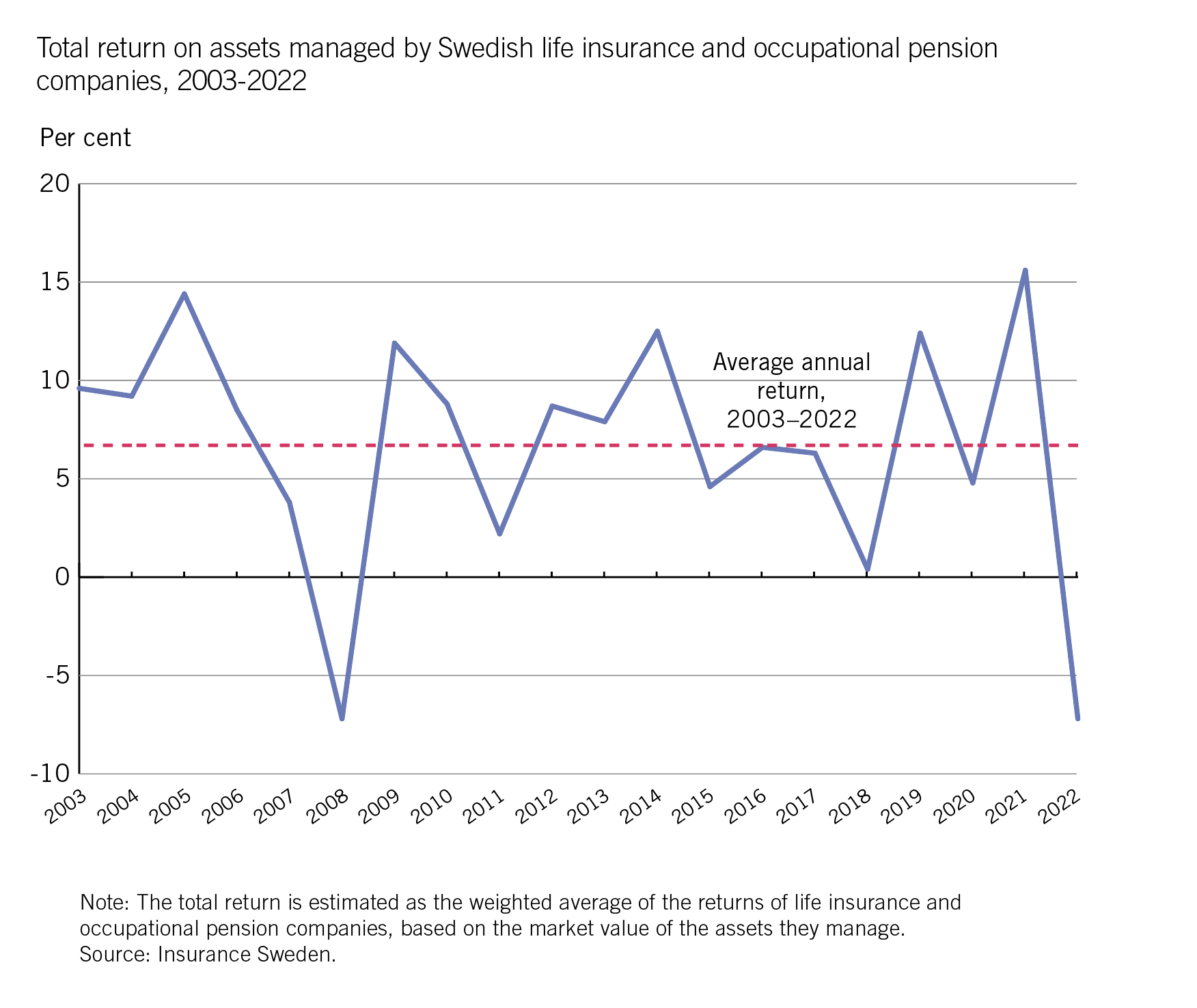

The return on assets held by life insurance and occupational pension companies is significant as it affects the level of future pension payments.

In 2022, the total return on assets managed by Swedish life insurance and occupational pension companies was -7.2 per cent (see figure 38). This is lower than the average annual total return of 6.7 per cent over the past twenty years. The low return in 2022 was primarily due to the poor performance of the stock markets in Sweden and globally, and the fact that a relatively large portion of the companies' assets are invested in equities. However, the return in a single year is of less importance as savings are long-term. Instead, it is the return over time that determines the level of future pension payments.